Coronavirus (COVID-19) Updates

For the most up to date Coronavirus Information, go to

Our responsibility is to provide up-to-date county specific COVID-19 information for the community.

Immigrants in Los Angeles County are worried about the coronavirus outbreak, and furthermore, how testing and treatment might affect immigration status. These concerns should not deter you from seeking out health or social services if needed.

County re-opening will occur in a controlled phased approach. For more information view LA County’s Roadmap to Recovery.

COVID-19 FAQs

Vaccines, Medical Testing & Treatment

- Will I be able to get vaccinated even if I don’t have immigration status?

- Will receiving free vaccination or treatment for COVID-19 make me a “public charge”?

- Do I need a government-issued ID to get vaccinated?

- How much does it cost to get COVID-19 vaccine if I don’t have health insurance?

- Do I need a car to go to a site and get the COVID-19 vaccination?

- I have other questions about the vaccine and vaccination process. Where can I find more information?

- Do I have to pay for COVID-19 testing if I have been exposed or have symptoms?

Financial Assistance

- I am an immigrant. Are there organizations that can help me and my family financially?

- Am I eligible for tax credits as an immigrant?

- I lost my job, or my hours have been cut. What can I do?

- Can undocumented persons and those who file taxes with an Individual Taxpayer Identification Number (ITIN) apply for Unemployment benefits, Disability Insurance or Paid Family Leave?

- Are DACA recipients and persons with TPS eligible for Unemployment benefits, Disability Insurance or Paid Family Leave?

- Are Independent Contractors eligible to apply for Unemployment benefits, Disability Insurance or Paid Family Leave? Are self-employed individuals eligible to apply too?

- Will I be considered a “Public Charge” if I apply for and receive Unemployment Insurance, Disability Insurance, or Paid Family Leave?

Housing & Eviction

- My landlord is trying to evict me because I can’t pay rent. What should I do?

- Is there any financial assistance available for immigrants who need help paying for their rent or mortgage?

- Will I be considered a “public charge” if I receive government aid to help with my rent or mortgage during the pandemic?

Small Business

Healthcare

- I lost my job and need healthcare, what can I do?

- What if my employer does not provide health insurance?

Utility Services & Telecommunications

- I am struggling to pay my utility bill due to the COVID-19 crisis, what can I do?

- Can I suspend my phone and/or internet payments during the state of emergency?

Property Owners

Vaccines, Medical Testing & Treatment

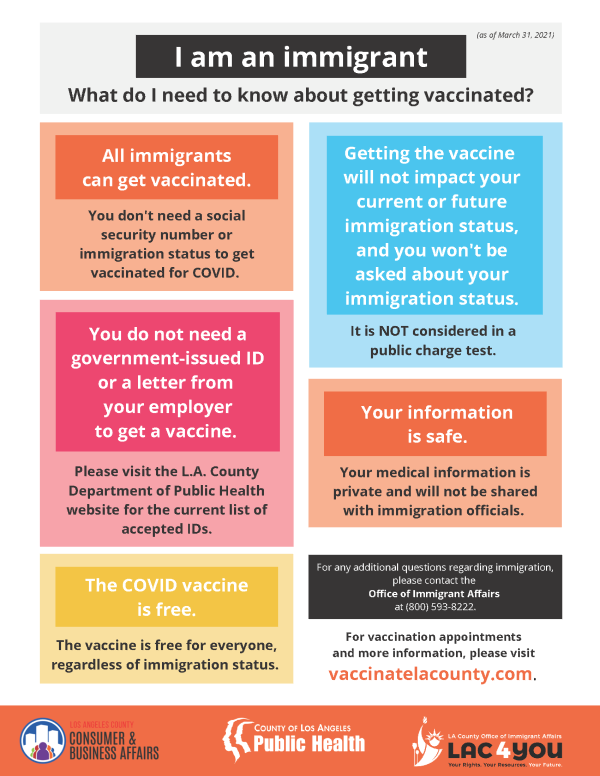

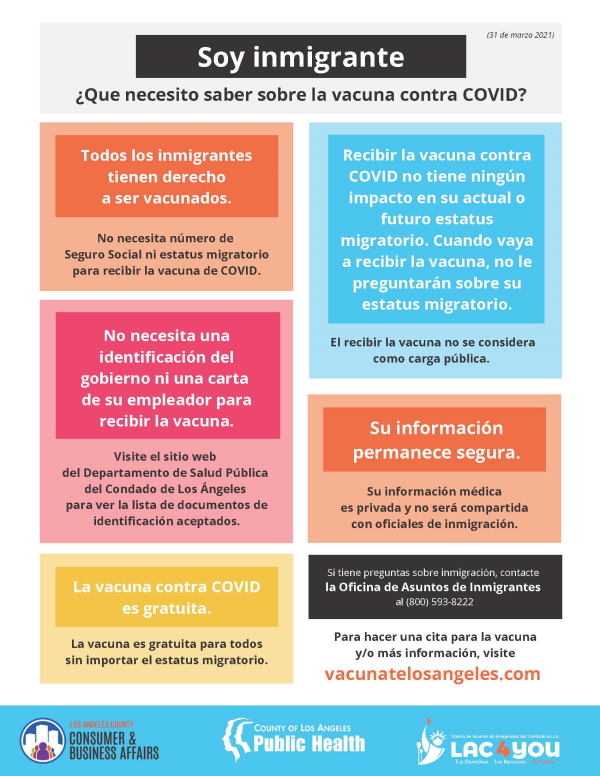

Will I be able to get vaccinated even if I don’t have immigration status?

Yes. The vaccine is available to all people regardless of immigration status. You do not need a Social Security number or any immigration status to get vaccinated. You will not be asked about your immigration status when you sign up or attend your vaccination appointment. Your medical information is also private. Your doctor is not allowed to share it with immigration officials.

Will receiving free vaccination or treatment for COVID-19 make me a “public charge”?

No. U.S. Citizen and Immigration Services will not consider testing, treatment, or preventive care, including vaccines, related to COVID-19, as part of a public charge inadmissibility determination. Also, as of March 9, 2021, the Department of Homeland Security is no longer applying the 2019 public charge rule. This means that immigrants can access important health, nutrition and housing benefits without fear of a negative impact on their immigration status. Very few benefits are considered under the current public charge rule. For more information, see the “Frequently Asked Questions” section on our Public Charge page.

Do I need a government-issued ID to get vaccinated?

No. You do not need to show government ID to get a vaccine. See “preparing for your appointment” on the Los Angeles County Department of Public Health’s vaccination appointment page for information about the documents needed to show you are eligible for a vaccine.

How much does it cost to get COVID-19 vaccine if I don’t have health insurance?

The federal government has provided resources to make the COVID-19 vaccine available at no cost for people who are uninsured regardless of immigration status.

Now that the COVID-19 vaccine is available in Los Angeles County, scammers are targeting local residents with vaccine-related schemes. To avoid these scams, keep in mind the following:

- Do not pay a COVID-19 vaccine.

- Do not pay for access for a COVID-19 vaccine.

- Do you give your personal information to anyone after you have applied through the County’s website.

Find more information about avoiding scams here.

Do I need a car to go to a site and get the COVID-19 vaccination?

Vaccination sites are available in locations that can be easily accessed through multiple modes (e.g., drive-up or walk-up) during a variety of hours (including evening and weekends) that accommodate different work schedules may help reduce access-related barriers.

I have other questions about the vaccine and vaccination process. Where can I find more information?

See the “Frequently Asked Questions” section of the Los Angeles County Department of Public Health’s vaccination page: www.vaccinatelacounty.com.

Do I have to pay for COVID-19 testing if I have been exposed or have symptoms?

No. Free COVID-19 testing is available to all persons who reside in Los Angeles County at drive-up and walk-up testing sites. Appointments are not currently required and you are able to register on-site at LA County and City testing sites (though appointments can also be scheduled in advance). Information about scheduling appointments, testing site locations/hours and other frequent asked questions is available here.

Financial Assistance

I am an immigrant. Are there organizations that can help me and my family financially?

- The California Immigrant Resilience Fund has raised over $75 million to provide cash assistance to undocumented Californians who are not eligible for other COVID-19 programs. You can visit the Caifornia Immigrant Resilience Fund website to see if you can benefit from this program. Additionally, local philanthropy has provided monetary and other forms of assistance. The California Community Foundation continues to receive donations for the COVID-19 L.A.County Response Fund. There is also a list of other hardship grant opportunities for specific populations at the California Immigrant Resilience Fund.

- The Department of Public Social Services provides a number of services. Contact them here: yourbenefits.laclrs.org/ybn/Index.html. If you don’t qualify for benefits due to your immigration status, other people in your home might. USCIS will not consider benefits received by household members in the public charge test.

- Free food at pantry locations throughout Los Angeles County can be found here. Many school districts also offer free meals for students. Check with your school district office.

- Depending on an individual’s situation, there may be other financial resources available from local government, private foundations, industry or trade organizations. Please note that these resources are limited and not every person who needs assistance will qualify. You may call OIA for additional information.

Am I eligible for tax credits as an immigrant?

- The California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit (YCTC) are state tax credits for working Californians.

- For the first time, Californians who file their taxes with an ITIN — including undocumented Californians — can qualify for the CalEITC and YCTC. This can mean hundreds or even thousands of dollars in refunds for immigrant households. Information about your eligibility and finding free tax preparation assistance is available here.

I lost my job, or my hours are cut. What can I do?

If you have a work permit, you may apply online for Unemployment Insurance (UI) with the California Employment Development Department (EDD). While undocumented immigrants cannot receive Unemployment Insurance, you may be eligible for Disability Insurance or Paid Family Leave. To file with EDD, click here.

For additional help, the L.A. County Business & Worker Disaster Help Center provides tools and direct support to access emergency resources. Call 800-593-8222, email DisasterHelpCenter@lacounty.gov or visit lacountyhelpcenter.org.

Can undocumented persons and those who file taxes with an Individual Taxpayer Identification Number (ITIN) apply for Unemployment benefits, Disability Insurance or Paid Family Leave?

- Unemployment Insurance (UI) is available for persons who are authorized to work in the U.S. and meet other requirements. Eligibility information is available here.

- All workers, including undocumented immigrants who use an ITIN, may be eligible for Disability Insurance and/or Paid Family Leave if they meet eligibility requirements. More information about Disability Insurance eligibility is available here. More information about Paid Family Leave is available here.

Are DACA recipients and persons with TPS eligible for Unemployment benefits, Disability Insurance or Paid Family Leave?

Yes. DACA and TPS beneficiaries are employment-authorized, therefore they are eligible for Unemployment Insurance. Like all persons who pay into the system, they are also eligibility for Disability Insurance and Paid Family Leave.

Are Independent Contractors eligible to apply for Unemployment benefits, Disability Insurance or Paid Family Leave? Are self-employed individuals eligible to apply too?

Yes. The Pandemic Unemployment Assistance (PUA) under the federal stimulus bills made independent contractors and self-employed individuals eligible for Unemployment Insurance for up to 86 weeks of benefits, beginning February 2, 2020. Find additional information or apply through the California EDD website.

Will I be considered a “Public Charge” if I apply for and receive Unemployment Insurance, Disability Insurance, or Paid Family Leave?

No. Unemployment, disability insurance, and paid family leave are considered earned benefits that do not count toward the “public charge” determination. For more information, see our Public Charge page.

Housing & Eviction

My landlord is trying to evict me because I can’t pay rent. What should I do?

Governor Newsom signed legislation in January to extend the state’s eviction moratorium through June 30, 2021. The Los Angeles County Temporary Eviction Moratorium is also currently in effect through June 30, 2021. To get more information, please call a Rent Stabilization counselor at (833) 223-RENT (7368) or email the L.A. County Rent Stabilization Unit at rent@dcba.lacounty.gov.

Is there any financial assistance available for immigrants who need help paying for their rent or mortgage?

State legislation provides renters, homeowners, and small landlords with relief if COVID-19 or quarantine impacts your ability to pay all or part of your rent or mortgage. You may qualify for this assistance regardless of your immigration status. Learn more about the Housing is Key program here.

For property owners, many major banks including Bank of America, Citi Bank, US Bank, Chase, and Wells Fargo are offering mortgage forbearance assistance to clients who are experiencing difficulty to make mortgage payments due to COVID-19 impacts. If you are already receiving mortgage forbearance assistance from your bank and your initial 12-month period is about to end, you may be eligible to extend your forbearance period. Please reach out to your bank for individual program requirements.

Additionally, a foreclosure moratorium for homeowners is currently in effect through June 30, 2021. Please contact the Los Angeles County Disaster Help Center at (833) 238-4450, to assist you with inquiring about your eligibility.

Will I be considered a “public charge” if I receive government aid to help with my rent or mortgage during the pandemic?

No. These forms of emergency and pandemic assistance are not considered in a public charge test. See our Public Charge page for additional information about the public charge rule.

Small Business

I only have an ITIN. Can I qualify for a business loan?

Unfortunately, various business loan products administered by the U.S. Small Business Administration under the federal stimulus bills are not available to business owners who do not have valid Social Security numbers.

However, the LA Regional COVID-19 Recovery Fund, a partnership among the County of Los Angeles, the City of Los Angeles, and institutional and corporate philanthropy, was designed to fill in this gap by supporting micro-entrepreneurs, small businesses, and non-profits with loan and grant resources. Learn about eligibility, sign up for updates or apply here.

You may also visit the L.A. County Disaster Help Center for additional resources for businesses from local governments and private agencies.

Healthcare

I lost my job and need healthcare, what can I do?

If you lose your job and it provided your health insurance, you can keep your coverage for up to 18 months if you pay for it yourself (which typically makes the cost significantly higher). Your former employer must send you a COBRA letter within the 14 days after you stop working. You have 60 days to say yes or no (and you can change your mind if you originally decided no, as long it’s within the 60-day window). For more information, talk to your employer or human resources office, visit the Department of Labor online or call 866-444-3272.

You may also be eligible for Medi-Cal, a free or low-cost healthcare coverage for low-income individuals and families. All Californians age 25 and under may qualify for full-scope Medi-Cal regardless of immigration status. Visit the Department of Public Social Services “Your Benefits Now” website to apply online, or call OIA at 800-593-8222 if you need assistance to apply for benefits.

What if my employer does not provide health insurance?

If your employer doesn’t provide health insurance, or if you’ve lost your job, you may be able to purchase a plan through Covered California. While open enrollment is typically in the fall, due to the impact of COVID-19, there is a special enrollment period for Covered California through May 15, 2021. Find more information about Covered California special enrollment here.

The American Rescue Plan also offers additional financial assistance for individuals and families to purchase health insurance through Covered California. Learn more here.

Uninsured LA County residents age 26 or older may also receive free health care through the My Health LA (MHLA) Program. To enroll or learn more about the program, please call MHLA Member Services at (844) 744-6452 Monday through Friday 7:30 a.m. to 5:30 p.m. You may also enroll by visiting a MHLA participating clinic. More information is available here.

Utility Services & Telecommunications

I am struggling to pay my utility bill due to the COVID-19 crisis, what can I do?

Many utility companies are not shutting off services due to non-payment. Please call your local utility company and ask for any available assistance or a flexible payment plan if you’re struggling to pay.

Southern California Gas Company information is available here. Southern California Edison information is available here. Visit the Los Angeles Department of Water & Power (LADWP) website or call 1-800-DIAL-DWP.

Also, the Water Board has restricted water service shut-offs during the COVID-19 crisis. Fill out this form to report any water shut off or reconnection issue. Language assistance is available (en español) for Spanish speakers to report water shut-offs by calling 916-445-5617.

Can I suspend my phone and/or internet payments during the state of emergency?

If you are in a financial situation that prevents you from paying your phone/internet bill, you should call your service provider to discuss your options. However, these options do not mean you are not being charged for services during this time so if you are in a position to continue making your payments, it is highly advisable to do so.

Property Owners

When are property taxes due?

Although property taxes are collected by the County, the deadline is set by the state. The property tax deadline for Los Angeles County residents remains unchanged from April 12, 2021. However, the State of California is waiving the penalty fees until May 6, 2021 through a governor’s executive order. For more information, or to request penalty cancellation for late property tax payments, visit the County’s Treasurer & Tax Collector’s website or call: (213) 974-2111.